As of 3/25/16 Tucker Hamilton is no longer with Farmer’s Coop. He has gone back to his home area by Newcastle WY to farm and ranch. Everyone at Farmer’s Coop wishes him success in his new venture!

Tucker Talk

Tucker Talk: March 4, 2016

White 4-Pod at FCE

The 2016 revenue protection spring price for corn is $3.86. This is the average December futures price over the month of February. The harvest price will be the average December futures price over the month of October.

Corn exports did better than expected last week and even though total exports are behind last years, the exports last week were higher than the same week last year. Gulf corn offers to Asia have finally drifted low enough to be within $0.05 of offers from Argentina which will leave the US open for corn bookings.

Crude oil prices rallied today to 2-month highs but traders consider it short-covering rather than a bullish change in fundamentals.

Increased weather risk has caused a $0.20 rally in wheat over the last 3 days. Warm temperatures have caused wheat to break dormancy 4 weeks ahead of schedule in important growing areas. Most wheat producing areas are still under statistically high probability of a hard freeze until March 31st. Areas such as Kansas and Oklahoma will need more moisture in order to keep the wheat going but rains are having a hard time developing. Large rallies will be limited by increased farmer selling and moving of on-farm grain stocks.

Tucker Talk: February 19, 2016

Early Morning Sunrise in Hemingford

The state-run company of ChemChina purchased Syngenta a couple weeks ago. ChemChina believes that this purchase will help advance the acceptance of GMOs with the populace of China. This is also a major step for China in moving towards improving their national corn yield by 25-30% through the applications of GMOs and the complimentary technologies.

The Conservation Reserve Program (CRP) is a popular choice this year with depressed prices across all commodities. In October of 2015 there were 23.55 million acres signed up for the program with a cap of 25 million acres. The deadline for the current sign-up period is February 26, 2016 That cap drops to 24 million acres next year and will remain there until 2018.

Recent warm temperatures across the mid-west U.S. have eliminated snow cover and caused wheat to emerge from dormancy in many ares. Pictures out of Oklahoma and Texas show winter wheat 2-3 inches tall. Concerns are arising over the increased risk of winter wheat freezing over the next 2 months.

Ergot was of significant importance in the 2015 wheat harvest at Farmer’s Coop locations with some wheat being rejected. The acceptable level of tolerance for the presence of ergot bodies is 0.05% or about 10 bodies in a coffee can. 0.05% is an extremely low tolerance level and is the international standard. There has been some confusion with Egypt over the last couple weeks. Egypt rejected a load 2 weeks ago and it was thought that the issues were worked out but then they rejected more loads this week. Egyptian agricultural authorities announced that 0.05% would be accepted but offers to sell wheat to Egypt are scarce due to the confusion. You would probably be leery too if you had a ship full of wheat rejected on delivery. You can read more on ergot at the links below.

Ergot in Wheat: A Brief Summary

Climatologists met yesterday to forecast spring and summer weather conditions in 2016. They concluded that given the current trend in the El Nino/La Nina pattern, there is an increased likelihood of above normal temperatures throughout the entire central region of the U.S. and an increased likelihood of below normal precipitation throughout the Great Lakes region. They predict that the current El Nino trend, which has moved from strong to neutral since January, will last through March. If it moves quickly into a La Nina pattern we could see drought conditions across the mid-west.

Interesting News: Pope Francis, the internationally recognized head of the Catholic Church and Patriarch Kirill, the head of the Russian Orthodox church met last week. This is the first meeting of the two leaders since the split of the catholic church in 1054 when each leader was excommunicated by the other. This meeting has no doubt been spurred by the threat of ISIS against Christians all over the world. The Catholic Church and the Russian Orthodox Church are planning on joining forces to combat the Muslim threat against Christendom. Once again the Christian and Muslim worlds are in conflict but instead of the Christians invading the Muslim world (400 years of crusades) the Muslims look to be invading the Christian world (terrorism?).

Tucker Talk: February 5, 2016

Hemingford Sunrise

Markets are down yesterday and today after a week of short covering by the managed money crowd. The commodities markets saw slight rallies over the past couple weeks as buying interest increased. However, there is no fundamental news to help continue the rally so with a poor export sales report Thursday, managed money began selling contracts again. In the export sales report 66.2 thousand metric tons of wheat were sold last week compared to the 397.6 this week last year. US wheat is still $0.70/bu overpriced to the rest of the world. USDA will probably lower export numbers in the February Supply and Demand report on Tuesday February 9.

Egypt rejected a load of wheat from France due to some Ergot concerns. Egypt was maintaining zero tolerance for ergot even though the GASC (General Authority for Supply Commodities) has a 0.05% tolerance level. Egypt modified their tolerance levels when they stopped receiving offers for wheat and is expected to be back in the market today.

The CME has responded to concerns involving high volatility in the cattle futures. CEO Terry Duffy met with state cattle associations and made a general presentation at the National Cattlemen’s Beef Association in San Diego, CA last week to address the main issues and changes that could be made. Reducing the intra-day volatility of the cattle futures will hopefully result in a better risk management tool for cattle dealers. Cattle currently consists of approximately 1% of CME trading.

Read more here.

Tucker Talk: January 21

Soybeans

More people in Box Butte County are talking about soybeans these days so I thought I would include a little market information. Export loadings are up from last week but are still 11% behind last year and 8% behind USDA estimates. Informa increased their soybean planting acreage estimate by 2.5 million acres from 2015 on Tuesday with some acres shifting from corn to soybeans. The shift in acreage may be due to a possible mass exodus of producers from corn to soybeans because soybeans are cheaper to grow. Returns for soybean, although still negative, are currently better than corn and could be considerably better if weather does not cooperate and yields move back to average from the high levels we have seen the last two years.

Corn

There has been a welcome $0.18 rally over the last 2 weeks bringing corn back up to a $3.20-$3.25 cash price range but it is being offset by weakening basis levels. The rally has been attributed to short covering of managed money that was short 195 thousand contracts on Friday. After the funds stop buying, we will need another reason for them to continue buying corn contracts to drive the prices up. We have seen some corn movement across the country but mostly from elevators moving corn in preparation for the coming year. Producers are still not selling and are instead taking advantage of delayed pricing programs in order to let the elevators move the grain.

I have been talking about the El Nino/La Nina pattern and its importance to 2016 prices. El Nino is attributed to granting our excellent yields over the last two years and has recently started moving to a neutral position. If it stays neutral for another year then we will probably see good yields again, however, if it moves into a La Nina, it could result in drought conditions and cause reductions in supply. Unfortunately, this is what is needed to drive prices up to profitable levels.

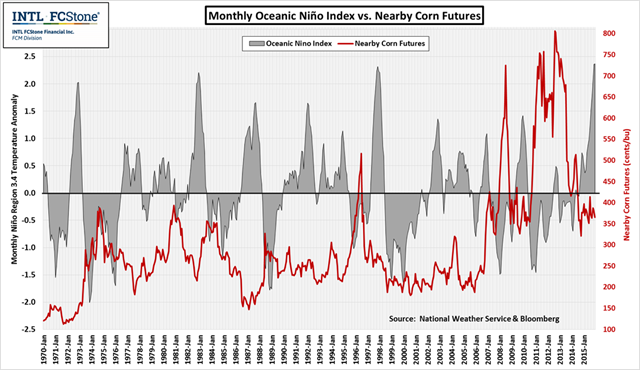

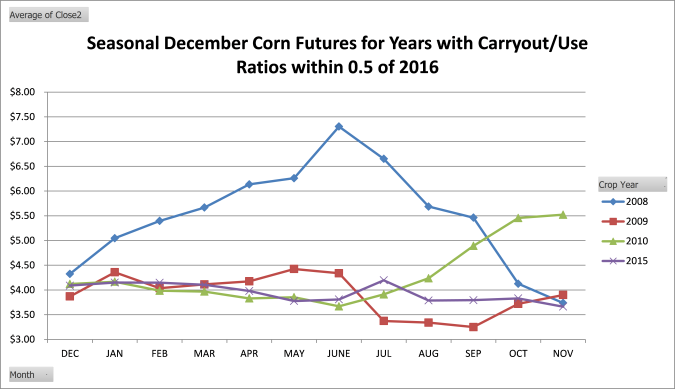

The first chart below is an interesting chart of the El Nino/La Nina pattern with an overlay of corn futures. When the gray line is above the horizontal black line, it is a strong El Nino and when it is below it, it is a La Nina. As you can see, there is an inverse relationship between the El Nino/La Nina and corn futures. The second chart shows seasonal December corn futures in years with high carryout similar to the 2016 year we are currently entering. The transition to a La Nina event occurred in 2007, going into 2008 and in 2010 and the impacts on prices can be seen in the second chart. It is interesting to compare the two charts and one conclusion I can make is that unless we transition to a strong La Nina, the highest prices we see for new crop may be in the February-March period. It may be a good idea to forward contract some during this time period to reduce your risk.

El Nino Index vs Corn Futures.

Seasonal December Corn Futures

Tucker Talk: January 8

A little green to warm your soul.

Corn closed $0.04 higher today, the first positive day since the Monday before Christmas. Most of the rally is attributed to fund movement. Monday this week saw significant losses in all commodities after as Chinese stock market drop the night before. On Sunday night, Chinese manufacturing data came in bearish at the same time as a major devaluation of the Chinese Yuan from the government. The Chinese stock market dropped the limit on Sunday night forcing shut down and again later in the week. This weighed heavily on commodity prices this week so the rally today is welcome.

The main force working against U.S. commodity prices is the strong value of the dollar relative to other world currencies. The U.S. commodities are expensive and have resulted in exports for corn being 25% behind last year and 19% below the USDA estimates in the December supply and demand report. The next major mover and shaker in the markets will be the January supply and demand and stocks and acreage reports. Trade is currently debating numbers for export changes, South America production, feed usage, and prevent plant acreage usage. The overarching story remains the same however, world supply is plentiful for all commodities and this will only change if there is a major event that has drastic impacts on this year’s production (weather is usually the culprit).

On a positive note, we often forget that world demand for corn and wheat continues to increase every year. Depressed prices draw more consumers and end-users that increase demand further. If demand makes some major increases, then prices go up. This is economics 101.

Tucker Talk: December 31

Prices have not looked good over the past two weeks with corn making new contract lows on Tuesday. Traders shored up their positions before they left for Christmas break and many of them will not return until after the new year. Farmer selling is sparse as producers balance their books before they roll into a new tax year. This low volume and lack of interest results in increased price volatility.

China is petitioning for no dumping on distiller grains in order to use up domestic supply of out-of-condition corn. Trade is still trying to determine what will happen if China actually halts imports of DDGs. Legal proceedings will most likely bring a halt to this in the future but it is doubtful that the US will see any benefit from this as our corn is still overpriced compared to South America.

El Nino is considered to have peaked and is on its way to either La Nina or neutral status. A weak to strong El Nino is expected into the spring and could result in average to above average yields. Some traders are already predicting a larger corn crop than what is currently being estimated. Meanwhile, Mississippi freight is shut down due to flooding, and severe winter storms are impacting the Southwest.

If world demand doesn’t rise, the strong dollar may result in higher carryout and the US being the reserve holder for corn until it is needed. Foreign currency weakness is also to blame for the lack of foreign demand for US commodities. Any strengthening in foreign currency values would be just as supportive to our market as a devaluation of the US dollar. Corn exports are 15% behind the pace needed to reach the USDA projected total.

Cattle prices rallied after a surprising cattle on feed report on December 18th and continued as winter storm Goliath hammered the southwest US. An estimated 20,000 head of dairy cattle, ranging from small calves to cows, were lost as snow and ice drifted 15-20 feet deep. A cheese plant reported that they only received 10% of their normal milk deliveries on Monday. Cows that can’t be milk will show reduced production for months to come. Goliath is being compared to winter storm Atlas that occurred in South Dakota a couple years ago. Many of us were not affected by this storm but to many it will always be known as the winter of 2015.

Tucker Talk: December 18

Merry Christmas!

The week started out with the usual short covering for traders who plan on taking off for the holidays and was smashed on Wednesday. Several pieces of news came out on Wednesday that, when combined, cause two days of weak markets. First, the Federal Reserve raised its interest rates by 0.25% which the trade has been expecting. Second, Argentina released its restrictions on exchange rates with the dollar causing a devaluation of the Peso by approximately 40%. Trade knew this devaluation was coming but was expecting a laddered approach rather than a sudden release. Third, the US embassy in China received official notice from the Ministry of Commerce of formalizing the anti-dumping claim against US DDG. Argentina’s reduction on export taxes coupled with its devaluation of the Peso is expected to greatly increase the number of exports from the country. This news caused a major bump in the dollar and severe drops in prices with Kansas City March wheat losing $0.11 and March Corn losing $0.07.

The weak markets continued Thursday morning but were pulled up by continued short covering and a rally in the Soybeans. Fresh news from South America of dryness preventing planting in some major Soybean areas spurring a needed rally.

Markets will trade normally next week until Thursday. They will close an hour early on Christmas Eve (11:00 PM) and will remain closed until Sunday night for the normal night trading.

Wheat

Wheat has continues to be a dog in the market despite a slight, pre-holiday, short covering rally. Argentina is expected to become a competitor in wheat exports in the next few months due to the elimination of the export tax on wheat and the devaluation of the Peso. Any rally in wheat futures is expected to knocked down by widened basis in the cash market in order to keep wheat values competitive in the world market. Informa increased their estimate of winter wheat production by 11 million bushel based on FSA data of increased wheat planted acres.

As producers, we often forget about the other side of the coin that is the demand side. Economic theory dictates that when prices are low, you will see new demand enter the market which in turn causes prices to increase. This demand is either new buyers entering the market thinking they can make a profitable margin from the lower input prices or from the consumer substituting to the cheaper product. There has been unconfirmed rumors of old wheat mills re-opening because margins look better.

The year is coming to an end and there were several newsworthy events this year. This article provides a good summary of the year’s major economic events and provides good links for topics that interest you. I would recommend it.

Tucker Talk: December 11

Corn

Corn rallied over the past several weeks spurred by short covering before the holidays and remains bullish in what traders are calling a seasonal tendency. Corn futures have a strong tendency to rally from the beginning of December through late winter and sometimes into spring and early summer. The large amount if corn in storage and the need to remain competitive in the world market will limit rallies in the cash market as buyers adjust basis. Basis values have already weakened $0.05 across the U.S. as year-end movement has increased.

Net farm income is forecasted to be down 38% from last year which will obviously impact farm spending. Machinery and implement dealers will likely be the first to feel this impact with crops and crop inputs feeling the pressure. As prices remain depressed, more producers are sharpening their pencils and spending time and effort calculating break-evens in order to try to remain profitable. Sometimes another $50/acre in input cost could raise yield enough to bring break-evens above current prices.

The final USDA Supply and Demand report was released on Wednesday the 9th. Corn export estimates were decreased 50 million bushels and ethanol use was increased 25 million bushels in the wake of EPA’s increase in ethanol blending levels in gasoline. Overall, the report was quiet with year-end corn carryout was increased 25 million bushels.

Wheat

There is currently no heavy news in the wheat market to spur a rally. The USDA raised the wheat carryout number on the supply and demand report on Wednesday. It will take a while to eat through these stocks and the wheat prices may not see a recovery any time soon. The major factor in crop production is weather. The strong El Nino over the past year resulted in no weather concerns for wheat anywhere in the world. The question in the following year will be whether the El Nino will transition into a La Nina, causing a drought year, or if it will continue and cause another year of record yields.

Tucker Talk: November 23

Corn, wheat and cattle near Mirage Flats location.

Corn

Basis values continue to remain strong as producers are unwilling to sell at the current prices. Exports were larger than expected last week with a large sale to Mexico on Wednesday, but are still only 30% of what they were last year at this time. Brazil is actively offering corn to the world market 18-20 cents per bushel cheaper than the U.S.. Argentina’s new president takes office in December and he has some big ideas in reducing export taxes on commodities. We could see up to a 50% increase in both corn and wheat acres depending on the magnitude of reductions.

Historically, trade falls into an annual holiday pattern the week of Thanksgiving in which there is very little market participation, thus increasing market volatility. Traders often shore up their positions this week and then disappear until the first few weeks of the new year. With increased volatility we could see some unusual rallies that could allow farmers to achieve higher prices in the next month. However, this is the first year all trade is electronic and the impact on holiday season volatility is unknown.

Wheat

Wheat has a similar story to corn. There has been very little wheat movement apart from the occasional landlord and lien holder. Those that have committed to store until prices are more favorable have buckled down in hopes to at least see an improvement in basis levels.

There are some rumors that new mills are being built and old ones are being reclaimed due to attractive margins at current wheat prices. Basic economics tells us that when supply increases, price decreases. In response, lower prices may be attractive and we may see a corresponding shift in demand that will have a positive impact on prices.

Cattle

December live cattle are trading at $130, dropping $10 in the month of November but is currently at the same level it was at the end of September. January feeder cattle are trading at $163 after dropping $20 in November.

Trade is talking about high slaughter weights and rapidly expanding herd numbers. Whether or not the numbers support these perceptions doesn’t really matter when it comes to price movement. The market will move on what it perceives even if the fundamental story does not support it. Such are the shackles of perfect information.

The following is my own speculation drawing on my background in agricultural economics. The underlying problem with the cattle market in the last few months lies in basic supply and demand economics. A perfect storm consisting of prolonged severe droughts in key cattle areas, herd numbers being at the bottom of the “normal” cycle, and various other economic factors caused a significant increase in cattle prices. This in turn trickled through the supply chain and revealed itself to consumers as higher beef prices. Consumers are fickle and easily substitute cheaper chicken and pork for beef when it is more favorable to them. As supply has been increasing in the last few years, demand has been decreasing. If herd numbers rise back to the level they were before the “perfect storm,” it could be disastrous for prices if demand has been reduced by half. My point is that supply is only half the story and we shouldn’t forget about the other half.

Here I bring up a similar occurrence in the lamb industry, for which demand has all but disappeared. Prices for those meats were high, consumers substituted away, decided they liked beef more, and never came back. This scenario may be far-fetched and unlikely for the beef industry, but it is not impossible. The industry may need to look to the sheep industry and glean any useful knowledge it can about stopping a declining demand.

You must be logged in to post a comment.