Corn, wheat and cattle near Mirage Flats location.

Corn

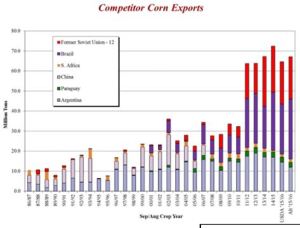

Basis values continue to remain strong as producers are unwilling to sell at the current prices. Exports were larger than expected last week with a large sale to Mexico on Wednesday, but are still only 30% of what they were last year at this time. Brazil is actively offering corn to the world market 18-20 cents per bushel cheaper than the U.S.. Argentina’s new president takes office in December and he has some big ideas in reducing export taxes on commodities. We could see up to a 50% increase in both corn and wheat acres depending on the magnitude of reductions.

Historically, trade falls into an annual holiday pattern the week of Thanksgiving in which there is very little market participation, thus increasing market volatility. Traders often shore up their positions this week and then disappear until the first few weeks of the new year. With increased volatility we could see some unusual rallies that could allow farmers to achieve higher prices in the next month. However, this is the first year all trade is electronic and the impact on holiday season volatility is unknown.

Wheat

Wheat has a similar story to corn. There has been very little wheat movement apart from the occasional landlord and lien holder. Those that have committed to store until prices are more favorable have buckled down in hopes to at least see an improvement in basis levels.

There are some rumors that new mills are being built and old ones are being reclaimed due to attractive margins at current wheat prices. Basic economics tells us that when supply increases, price decreases. In response, lower prices may be attractive and we may see a corresponding shift in demand that will have a positive impact on prices.

Cattle

December live cattle are trading at $130, dropping $10 in the month of November but is currently at the same level it was at the end of September. January feeder cattle are trading at $163 after dropping $20 in November.

Trade is talking about high slaughter weights and rapidly expanding herd numbers. Whether or not the numbers support these perceptions doesn’t really matter when it comes to price movement. The market will move on what it perceives even if the fundamental story does not support it. Such are the shackles of perfect information.

The following is my own speculation drawing on my background in agricultural economics. The underlying problem with the cattle market in the last few months lies in basic supply and demand economics. A perfect storm consisting of prolonged severe droughts in key cattle areas, herd numbers being at the bottom of the “normal” cycle, and various other economic factors caused a significant increase in cattle prices. This in turn trickled through the supply chain and revealed itself to consumers as higher beef prices. Consumers are fickle and easily substitute cheaper chicken and pork for beef when it is more favorable to them. As supply has been increasing in the last few years, demand has been decreasing. If herd numbers rise back to the level they were before the “perfect storm,” it could be disastrous for prices if demand has been reduced by half. My point is that supply is only half the story and we shouldn’t forget about the other half.

Here I bring up a similar occurrence in the lamb industry, for which demand has all but disappeared. Prices for those meats were high, consumers substituted away, decided they liked beef more, and never came back. This scenario may be far-fetched and unlikely for the beef industry, but it is not impossible. The industry may need to look to the sheep industry and glean any useful knowledge it can about stopping a declining demand.

You must be logged in to post a comment.