Corn

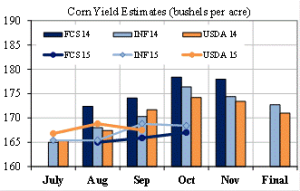

Harvest progress was 75% across the United States as of Sunday night even though here in the panhandle of Nebraska we are probably only at 10%. Sugarbeets are the priority and it’s just as well since the moisture on the corn is still in the high teens. Year to date the US has harvested 75% of its corn with an estimated average yield of 168 bu/acre which comes out to approximately 10.166 billion bushels. This is more corn than the total harvests of 2001 and 2003, and we are only 75% done.

Seasonally, the corn market tends to rally from now into December. In 2014 corn hit its low around this time and rallied $0.80 over the next several weeks due primarily to competition between soybeans and corn for acres. This year, corn made its low back in the beginning of September and has rallied $0.20 since then. Many analysts believe a rally as large as last year is impossible due to the fact that corn inventory and production are large this year.

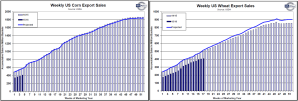

Trade is concerned about the slow pace of exports this year. China could buy 50% less corn as the government subsidizes the use of domestic corn. China reports that 25% of the 80 million metric tons of corn they have in storage is damaged so badly it cannot be used for food or feed purposes. China plans on increasing ethanol manufacturing by 200 million gallons per year to absorb these corn reserves. The economics behind this is seriously in question with margin calculations coming up negative.

Wheat

Wheat prices rallied significantly on Monday in response to flooding rains impacting the Winter Wheat crop across the deep South and the surprising fact that funds are shorter than expected. Since the closing of the live trading pit in July, trade has a harder time keeping track of contract positions between the weekly reports.

Reminder: Merchant Plus Marketing Deadline is Sunday November 1

You must be logged in to post a comment.